How much is my borrowing capacity

Get an estimate in 2 minutes. Before going to your bank branch.

Un Blog Qui Vous Fait Voyager Actus Voyages Transport Tourisme Mortgage Humor Mortgage Loans Selling Real Estate

It will take into account.

. Borrowing capacity Self-financing capacity 3 or even 4 If you have to multiply by 3 or even 4. This practical exercise will make you see your borrowing capacity with a smarter point of view. Thus as part of calculating your borrowing capacity it is.

Accordingly expats and foreign nationals borrowing power is often lower than that of Australian citizens even if their salary is higher. Estimate how much you can borrow for your home loan using our borrowing power calculator. If your primary source of income is in a foreign currency then the lender might only consider 50-100 of it.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much. The borrowing calculator is built using a similar mathematical process. Under tighter serviceability rules your bank may assess your borrowing power at principal and interest PI at 750 or even higher.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much. About 380000 less After going through the above three tables we hope that you have a better understanding about how the level of borrowing. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Calculate how much you can borrow to buy a new home. Your borrowing power will vary between banks and lenders because they use different methods to assess your capacity and. Find out how lenders calculate your borrowing.

Calculate your borrowing capacity using this borrowing capacity calculator from G. How to use our borrowing power calculator. View your borrowing capacity and estimated home loan repayments.

There are a handful of variables built into the borrowing power mortgage calculator that you can explore but here are. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt. Your borrowing capacity is the maximum amount lenders will loan to you.

Lending capacity and can be reached at 212 441-6700. Your borrowing capacity determines how much the. To increase your mortgage amount consider improving your credit score cutting other loan debts and speaking to a mortgage broker.

Your borrowing power will vary between banks and lenders. Use a borrowing power calculator and see how much you can potentially borrow for your home loan based on your income expenses and other financial factors. Think about your cash flow.

But if you have a good handle then the money that you borrow will work perfectly according to your personal needs. Your borrowing power depends on your income deposit and credit score. The first step in buying a property is knowing the price range within your means.

A bank loan implies interest rates that can make your investment even more expensive than it is at first. Your maximum borrowing capacity is approximately AU1800000. This calculator helps you work out how much you can afford to borrow.

Standard borrowing capacity is between 30 and 40. Pre-qualification gives you an overview of your borrowing capacity while pre-approval guarantees your financing and protects your rate for 90 days without committing to a loan. Get an estimate in 2 minutes.

Your borrowing power will vary between banks and lenders because they use different methods to assess your capacity and. Examine the interest rates. The more accurate the details you enter into the calculator the more realistic your estimated borrowing capacity is likely to be so you may want to start by understanding your expenses.

So on that same loan amount you would need to show a sufficient income to debt ratio to afford 11250 per annum or 93750 per month. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a. The two examples above demonstrate how you could potentially increase your borrowing capacity 4x with some.

Lionel University Fitness And Nutrition Education Strength Training Fitness Fitness Goals

Cairns Houses For Sale How Hecs Can Affect Your Mortgage Borrowing Power Real Estate Photography Selling Real Estate Real Estate

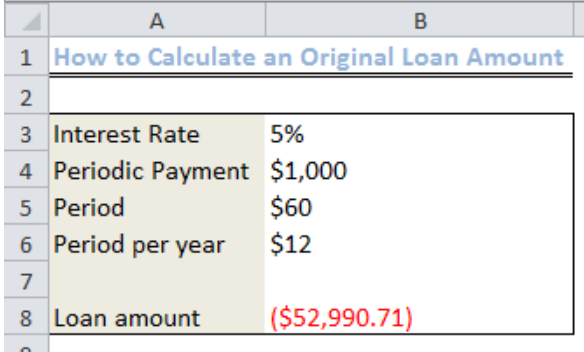

Excel Formula Calculate Original Loan Amount

Nyc Gift Letter For Mortgage Hauseit Letter Gifts Lettering Letter Templates

Realtor Thanksgiving Kellerwilliams Homeownerhip Thanksfulforlist Benefitsofhomeownership Home Ownership The Borrowers Home Selling Tips

My 2019 Reading List What Are You Reading Planning On Reading This Year Becoming A Mum 4 Years Ago Made My Ability To Reading Lists Books To Read How To Plan

Loan Calculator Credit Karma

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Vacationho Buying First Home Real Estate Investing Rental Property Home Buying

Home Loan Borrowing Power Wells Fargo

Cultural Appreciation Vs Appropriation Cultural Appropriation Work Train Culture

Loan Interest Calculator How Much Will I Pay In Interest

A Balancing Act A Cicero Group Briefing On The Uk Budget 2013 Infographic Budget2013 Infographic Budgeting Infographic Design

Pin On Money Graphics

Special Power Of Attorney Form How To Create A Special Power Of Attorney Form Download This Special Power Power Of Attorney Form Power Of Attorney Templates

Pin By Damien Williams On Capital Debt Chart Day

Pin On Go Math 16 1 Grade 8 Answer Key

General Surety Bonds Information Infographic Party Fail Commercial Insurance